February 6, 2026 — Pensions are almost as old as time. The first pension system in recorded history comes from the Roman Empire. During the rule of August Caesar, a pension plan was created to reward retired soldiers after 16 years of service in a legion and four years in the military reserves. Pensions were often monetary but sometimes came in the form of land grants or special government appointments.

In the centuries that followed, pensions were largely awarded to those who reached a certain age or served in the military. In the U.S., the first public pension plan was created in 1857 for New York City police officers injured in the line of duty. Later, firefighters were included as well. By 1878, the plan provided a lifetime pension for officers at the age of 55 following 21 years of service. Teachers in New York City gained a pension plan by 1894.

New York State did not offer a pension plan to public employees—through the Employees’ Retirement System (ERS)—until 1921, a year after the federal government established a pension for its civilian employees.

New York’s voters felt providing a public pension was so important that protecting public pensions was enshrined in the New York State Constitution in 1938 (Article V, Section 7). This Constitutional protection guarantees that benefits shall not be diminished or impaired. This provision, along with the entire NYS Constitution, is brought before the state’s voters every 20 years for consideration. In 2016, the last time this was brought before voters, changing New York’s pension plan was a major topic of discussion. In the end, 72% of New Yorkers voted against holding a Constitutional Convention and to support New York’s pensioners.

Today in New York State, pensions are defined by “Tiers” numbered 1 through 6. However, that was not always the case. From inception in 1921 until 1973 (52 years!), everyone received the same benefits. Tier 2 was introduced in response to a fiscal crisis in New York City. The major difference between Tiers 1 and 2 is the age at which a member receives full benefits. For Tier 1, employees can retire at 55-years-old with no benefit reduction if they retire early. For Tier 2, employees are able to receive full benefits at 62-years-old or at 55-years-old, provided they have 30 years of service to the state.

Only three years after the introduction of Tier 2, in 1976, Tier 3 was created. Employees hired after July 26, 1976, joined Tier 3, which requires employees to contribute 3% of their pay annually for 10 years. At the time of its creation, New York State cited rising pension costs as the reason for Tier 3. Tier 3 also had a provision called the “Social Security offset,” which reduced an employee’s pension equal to the amount they received from Social Security.

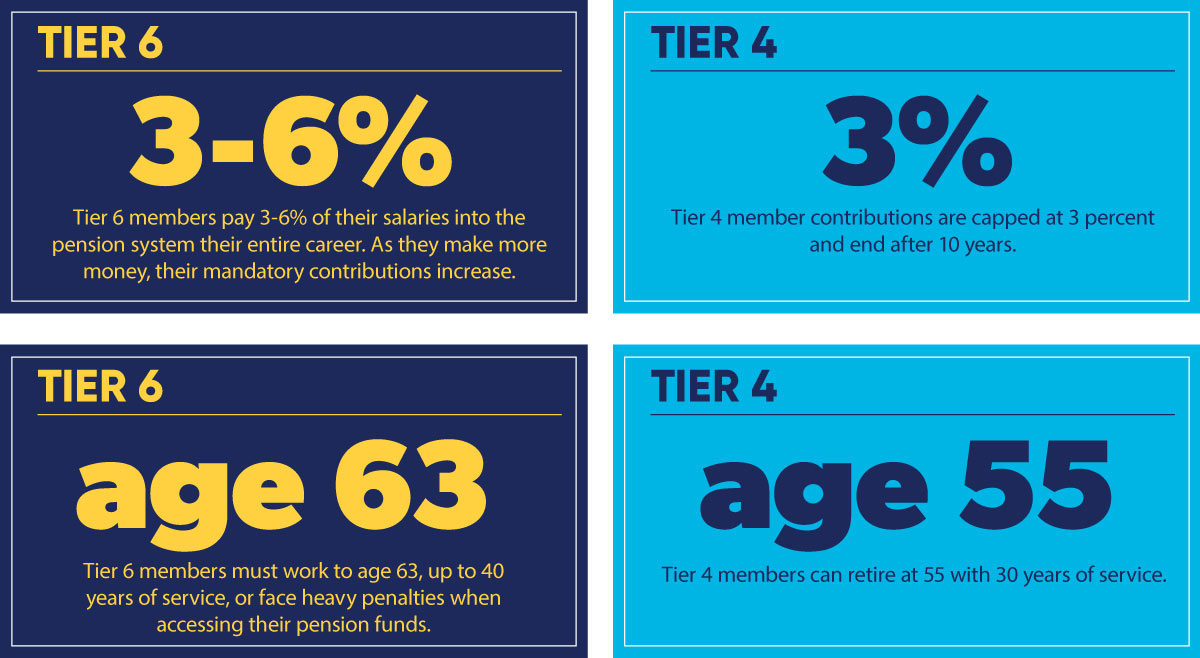

Tier 4, introduced in 1982, is very similar to Tier 3, but reduces the pension benefit for members who retire sooner than age 62 with less than 30 years of service. Tier 4 also eliminated the Social Security offset. As the retirement system became more solvent, public employers contributed less to the plan, and it was gradually improved.

The State waited 28 years before Tier 5 was created in 2010 by then Governor David Paterson, in response to the Great Recession of 2008. Tier 5 increased the penalties for early retirement significantly. Employees who wish to retire prior to age 62 now have their pension reduced by more than 38 percent. In addition, Tier 5 members must contribute 3% of their salaries to their pension throughout their entire career.

Just a year after the creation of Tier 5, former Governor Andrew Cuomo announced a proposal to create a new tier. At the time, Cuomo said that Tier 6 would “bring government benefits more in line with the private sector while still serving our employees and protecting our retirees.” The former Governor also cited, just like in 1976 when Tier 2 was created, a “skyrocketing pension burden.”

Tier 6 rolled back benefits once again. The age to receive full benefits increased from 62 to 63, and a longer “vesting” period was introduced. State employees now had to have 10 years of service in order to have access to their retirement benefits compared to 5 years in previous Tiers. In addition, employee pension contributions were increased to 3-6% of annual earnings, with no time cap. In other words, the more you make, the more you contribute to your pension.

In 2022, PEF and other unions successfully advocated to reduce the vesting period in Tier 6 back to five years. In addition, labor union advocacy in 2024 led to a change in the final average salary calculation used to determine pension benefits. It is now based on the average of an employee’s highest consecutive three years of salary, instead of five.

But the fight to reform New York’s pension plan continues. PEF and other public employee unions under the NYS AFL-CIO umbrella are pushing for additional changes to Tiers 5 and 6 so that the State can better attract and retain the professionals it needs to deliver services to New Yorkers. Proposals on the table include:

Lower the pension contribution for all employees: A higher percentage for newer workers is a disincentive for them to make a career in public employment and penalizes those who receive promotions or negotiated raises.

Eliminate arbitrary retirement penalties for career employees: Workers who commit their careers to a public employer should not be penalized when it is time to retire. Make retirement eligibility for members in Tiers 5 and 6 the same as for members in Tier 4 by allowing full retirement benefit for any member who is age 55 or older and has worked for 30 or more years.

Return to calculating pension with 2% of salary after 20 years of service.

A multi-union rally scheduled for March 8 at MVP Arena in Albany is “sold out” (the event is free, but ticketed), with thousands of union members from across the State expected to come together in the State Capitol to let the Governor and lawmakers know it’s time to “Fix Tier 6!” (And 5!)

Editor’s Note: If you’d like to send a letter to your State lawmakers urging them to “Fix Tier 6,” PEF has made it easy for you! Click here to get started.